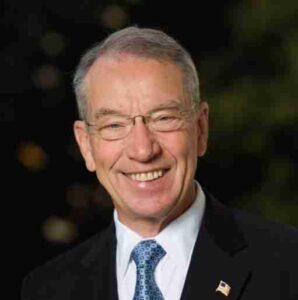

Sunday Talk: Grassley on Tax Season

Q: What should taxpayers know before filing their 2022 tax returns?

A: As lawmakers roll up their sleeves and get to work in the new session of Congress, taxpayers are getting their ducks in a row for tax season that got underway on Jan. 23. That’s the first day the IRS began accepting and processing returns for the 2022 tax year. The federal agency expects more than 168 million individual tax returns, due by this year’s April 18 deadline. As a longtime taxpayer watchdog, I keep the IRS on a short leash to prioritize taxpayer services. For example, when the Biden administration pushed last year to supersize the federal tax-collecting agency’s budget in the so-called Inflation Reduction Act, I co-sponsored a bill with Sen. John Thune to put teeth in how those $80 billion are spent to help ensure accountability and transparency to the taxpayer. We plan to re-introduce our legislation to rein in IRS overreach before it’s too late. Amplifying the enforcement powers of the IRS without robust oversight is an invitation for federal overreach and puts law-abiding taxpayers on edge for good reason. Consider the Biden administration’s plan shortly after the president took office to require financial institutions to report withdrawals and deposits on every working American. I introduced a bill with Sen. Tim Scott to nip that program in the bud.

Massively increasing the IRS budget without attaching congressional oversight strings undermines the authority of the people’s branch. That’s why I’m doubling down on my oversight work to fix what’s broken and ramp up taxpayer services. Consider more than half of the $80 billion in new IRS funding included in the partisan spending package enacted last summer is dedicated to enforcement, while less than five percent is carved out for taxpayer services. Keep in mind, at the end of last year the IRS had a backlog of more than nine million tax returns and only 13 percent of 173 million calls were answered by a live IRS representative, with an average wait time of 29 minutes.

As the former chairman of the tax-writing Senate Finance Committee, I’m all for improving tax compliance and narrowing the tax gap. That’s why I’ve worked to put meat on the bones of budget-responsible programs to catch tax cheats and collect tax debts. Between the IRS Private Debt Collection Program and the IRS whistleblower program that I’ve long championed, the federal government has collected nearly $10 billion from non-compliant taxpayers. Specifically, the IRS whistleblower program is structured to help expose tax fraud by corporations and wealthy tax cheats. Let’s be clear. Taxpayers should pay every penny owed, but shouldn’t be hassled and intimidated to pay a penny more. History tells us what happens when serving the taxpayer takes a back seat to stepping up enforcement: poor phone service and slow processing times, abusive collection tactics, lax protection of taxpayer data and even political targeting of law-abiding taxpayers.

Q: What is the Taxpayer Advocate Service (TAS)?

A: Since Iowans first elected me to Congress, I work to ensure the governments works for the people, not the other way around. That includes strengthening taxpayer rights. More than two decades ago, I steered through Congress a package of IRS reforms that created the Taxpayer Advocate Service (TAS), an independent organization tasked with troubleshooting and resolving problems that small businesses and individuals have with the IRS. By law, the National Taxpayer Advocate presents findings and recommendations in an annual report to Congress to identify the biggest challenges facing taxpayer compliance. In its most recent report delivered to Congress in January, the top 10 most serious problems are: processing delays; complexity of the tax code; hiring and training IRS workforce; deficient telephone and in-person service; insufficient online tools; obstacles to e-file and free file; IRS transparency; oversight and absence of tax preparer standards; taxpayer appeals; and, barriers facing overseas taxpayers. The Taxpayer Advocate acknowledged that taxpayers and tax professionals experienced “more misery” in 2022 with unprocessed tax returns and unanswered correspondence. I’ll continue working to improve taxpayer services at the Internal Revenue Service, including processing tax returns, paying refunds and benefits, and improving taxpayer compliance.