Grassley, Hassan, Wyden, Lankford Urge IRS to Address Threat of AI-Generated Tax Scams

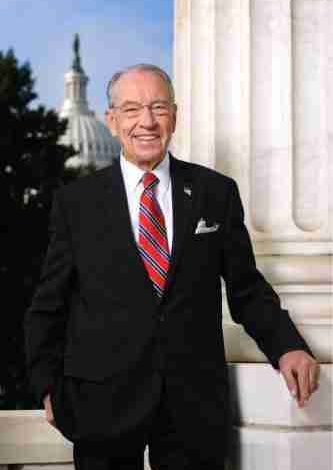

Sen. Chuck Grassley (R-Iowa) joined Sens. Maggie Hassan (D-N.H.), Ron Wyden (D-Ore.) and James Lankford (R-Okla.) in sounding the alarm on the potential use of artificial intelligence (AI), such as ChatGPT, to generate persuasive, tailored scams intended to rob Americans by accessing their personal financial information. In a letter to IRS Commissioner Daniel Werfel, the senators urged the IRS to educate taxpayers and tax professionals about the existence of AI-generated tax scams and ways to prevent falling victim to a scam. The senators also asked the IRS whether it expects these scams to become more common and how these scams might evolve over time.

“In previous tax filing seasons, many scam messages could be identified by spelling mistakes, grammatical errors, and inaccurate references to the tax code,” the senators wrote. “By contrast, tax scams generated by new AI tools are professionally composed and specifically tailored to trick vulnerable taxpayers.”

“According to recent reporting, one cybersecurity expert demonstrated how ChatGPT can be used to generate scam messages from the IRS targeting families, older Americans, and small businesses,” the senators continued. “For example, ChatGPT generated a fake email from the IRS claiming that, in order to receive a $1,450 tax refund, an individual needed to respond with personal financial information.”

The full text of the letter can be found here and below.

May 1, 2023

Dear Commissioner Werfel:

Recent reporting indicates that cybercriminals targeting U.S. taxpayers could use emerging artificial intelligence (AI) tools, including deepfakes and chatbots such as ChatGPT, to generate especially deceptive tax scams intended to steal Americans’ personal financial information and trick people into paying fake fines or taxes. In previous tax filing seasons, many scam messages could be identified by spelling mistakes, grammatical errors, and inaccurate references to the tax code. By contrast, tax scams generated by new AI tools are professionally composed and specifically tailored to trick vulnerable taxpayers. Given this emerging threat to taxpayers, including families, older Americans, and small businesses, we write to urge the Internal Revenue Service (IRS) to use all the tools at its disposal to counter AI-generated tax scams.

According to recent reporting, one cybersecurity expert demonstrated how ChatGPT can be used to generate scam messages from the IRS targeting families, older Americans, and small businesses. For example, ChatGPT generated a fake email from the IRS claiming that, in order to receive a $1,450 tax refund, an individual needed to respond with personal financial information. ChatGPT also produced a transcript between a scammer impersonating an IRS agent pressuring a senior to pay a fake tax debt. In a third example, a scam message generated by ChatGPT asked a business owner to provide their Employer Identification Number, payroll information, and a list of their employees’ Social Security numbers in order to receive the Employee Retention Tax Credit.

Given recent AI developments, we write to urge the IRS to counter AI-generated tax scams, and we request answers to the following questions by May 31st:

- How is the IRS preparing for a potentially significant increase in scams generated by emerging AI technologies, including deepfakes and chatbots, such as ChatGPT? What existing or planned initiatives does the IRS have to respond to AI-generated tax scams? Please discuss resources that the IRS is dedicating to understanding and addressing these issues.

- How will the IRS educate taxpayers and tax professionals about the existence and typical characteristics of AI-generated tax scams and ensure that warnings and information are delivered in a timely manner?

- How does the IRS expect AI-generated tax scams to evolve in the short term and medium term? Are AI tools, which can quickly and inexpensively generate tailored scam messages, expected to increase the overall volume of tax scams? How would this affect IRS taxpayer service?

- Has the IRS received any reports to date of AI-generated scams and, if so, does the IRS have an estimate of the total dollar amount related to these scams?

Thank you for your attention to this important issue. We look forward to your response.