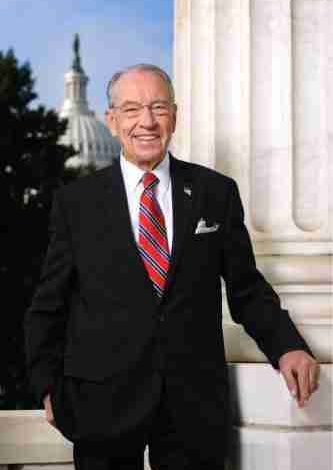

Sunday Talk: Grassley Says Biden’s Budget Turning a Blind Eye on Fiscal Health

With U.S. Senator Chuck Grassley

Q: How would President Biden’s budget impact the U.S. economy?

A: The president’s budget blueprint shows how unserious the Biden administration is about restoring fiscal sanity to the federal government. It was delivered to Congress 31 days late and falls trillions of dollars short of balance. As the ranking member of the Senate Budget Committee in the 118th Congress, I am fighting to bring kitchen table commonsense reforms to the budgeting process. Since Iowans first elected me to the U.S. Senate, I’ve served on the Budget Committee. Throughout my time in Congress, the U.S. economy has weathered boom and bust cycles, from peace and prosperity to war, natural disasters and pandemics. Speaking from experience, no matter which current the economy is riding, Potomac Fever is along for the ride. Washington views the 10-year budget window through rose-colored glasses – deficits are underestimated in the decade ahead. So, it’s not terribly surprising that President Biden’s budget turns a blind eye to the fiscal mess ahead. But we can’t afford to keep kicking the fiscal can down the road from one year to the next. Nearly 40 years ago under a Republican administration, I made this very case on the floor of the U.S. Senate when Congress was eyeing $200 billion deficits. That’s chicken feed compared to President Biden’s deficit spending. Over the 10-year budgeting window, the president’s budget proposes $17.1 trillion in cumulative deficits and raises taxes on every segment in America. Don’t forget, the Biden administration is trying to push through a $400 billion student loan bailout and already implemented unilateral expansion of the food stamp program. Now, the president’s budget would put federal spending on permanent crisis mode. Under his budget, spending levels as a share of our economy in each of the next 10 years would exceed what Congress spent at the height of the 2008 financial crisis. Put simply, the president’s budget proposal is a roadmap to fiscal ruin. As stewards of the public purse, lawmakers must restore fiscal discipline before we cross a bridge of no return. As family farms face high input costs, small businesses tighten their belts with workforce shortages and American households struggle to pay their bills and afford groceries, the Biden administration downplays inflation, doubles down on deficit spending, takes more money out of people’s pockets and expands government’s bite of the U.S. economy. Recent bank failures add to the nation’s economic uncertainty and underscore how important it is to shore up the government’s fiscal health. It’s time to put the brakes on the reckless spending binge. I served on the Budget Committee when we balanced the federal ledgers from 1998 to 2001 and used the budget surplus to pay down the national debt. Biden’s budget delivers a shameful record of debt held by the public. By the end of the budget window, public debt as a share of the economy would reach 110 percent.

Q: Why are climbing interest costs on the debt detrimental for Americans?

A: Every dollar spent on interest costs is one less dollar available for public services or tax relief. Consider how interest payments impact household budgets. Borrowers get bogged down when accrued interest swallows up the lion’s share of monthly credit card payments, restricting purchasing power for food and other essentials. Just as a family or business incurs more debt to make good on past debts, the federal government risks entry into a vicious debt spiral as interest costs climb. President Biden’s budget estimates that interest on the debt will cost more than national defense spending. Interest costs nearly triple from $476 billion in 2022 to more than $1.3 trillion in 2033. Over the next decade, Americans would be on the hook for a staggering $10.2 trillion in interest costs. This week, I questioned White House and Cabinet officials testifying before the Senate Budget and Finance Committees. They can talk until they are blue in the face, but the president’s budget blueprint is disconnected from fiscal reality. It would increase debt held by the public from $25.9 trillion in 2023 to $43.6 trillion by 2033. That surpasses the previous record of debt held by the public as a share of the nation’s economy (GDP) set in the wake of World War II. We owe it to the next generation to stop living high on the hog so that the American Dream doesn’t become a fictional pipe dream for our children and grandchildren.