Grassley, Finance Committee Republicans Introduce Bill to Prevent Middle Class, Small Businesses from Supersized IRS

Legislation would codify Crapo amendment to prevent IRS funding from targeting Americans earning below $400,000

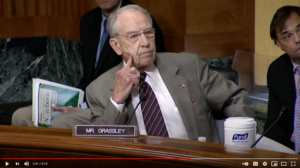

Sen. Chuck Grassley (R-Iowa) joined Senate Finance Committee Ranking Member Mike Crapo (R-Idaho) and fellow Committee Republicans to introduce a bill to prevent the Internal Revenue Service (IRS) from using its massive, $80 billion infusion of taxpayer dollars to squeeze more revenue out of American taxpayers who earn less than $400,000 per year.

“In order to pay for their massive partisan spending agenda, Democrats plan to sic the IRS on hardworking middleclass Americans who will be forced to hire accountants and attorneys to defend themselves or give into the IRS’s expanded audits. This bill shields middleclass Americans from this abuse,” Grassley said.

“In order to pay for their massive partisan spending agenda, Democrats plan to sic the IRS on hardworking middleclass Americans who will be forced to hire accountants and attorneys to defend themselves or give into the IRS’s expanded audits. This bill shields middleclass Americans from this abuse,” Grassley said.

“Democrats cannot achieve their desired tax revenue goals without targeting the middle class, small businesses and taxpayers earning under $400,000 per year–taxpayers who cannot afford teams of lawyers and legal fees–which is why they rejected my original amendment. While advocates promise they do not intend to increase audits on people making less than $400,000, the best way to protect those taxpayers is to turn that promise into law,” Crapo said.

The legislation would prevent the IRS from using any of the supersized $80 billion of funding for audits on hard-working American taxpayers, including individuals and small businesses, with taxable incomes below $400,000. The bill has teeth, in contrast to unenforceable, nonbinding statements of intention or unenforceable, vague Treasury Department edicts to not squeeze more revenue out of the middle class.

The bill is co-sponsored by all Senate Finance Committee Republicans and can be found HERE.