Grassley Proposal Seeks to Help Families, Students Overcome Effects of Inflation

Several key tax provisions that benefit low and middle income Americans currently do not account for soaring inflation

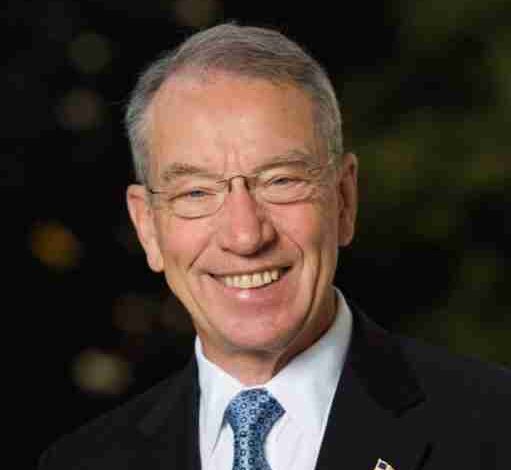

Sen. Chuck Grassley (R-Iowa), a senior member of the Senate Finance Committee, introduced new legislation that seeks to help Americans struggling to afford everyday expenses keep more of their hard-earned money. Iowans are paying an average $669 more per month on living expenses since President Biden took office. Iowa State University released a report showing inflation has resulted in the equivalent of a 33 percent cut to rural disposable incomes. In an effort to cushion the blow that inflation has dealt to Americans’ budgets, Grassley’s proposal would index certain tax benefits to adjust for inflation – including tax credits and deductions that benefit parents and students.

“The relentless 40-year high inflation we’re seeing today has made it increasingly difficult for Americans to afford their trips to the gas station and grocery store. Coupled with my Middle-Class Savings and Investment Act, indexing useful tax credits to inflation – like the Child Tax Credit and the Lifetime Learning Credit – will help parents and students keep up with rising costs. While President Biden has failed to produce any meaningful solutions to the economic crisis he created, I’ll continue working on commonsense policies that will help Americans weather this soaring inflation,” Grassley said.

Grassley’s proposal, the Family and Community Inflation Relief Act, would help parents by adjusting the Child Tax Credit and the Non-Child Dependent Credit’s phase-out thresholds and credit amounts for inflation. Additionally, the legislation provides relief for college students and their parents by adjusting for inflation existing education-related tax benefits, including the American Opportunity Tax Credit, Lifetime Learning Credit and Student Loan Interest Deduction. To prevent adding to the deficit, Grassley’s proposal includes an extension of the current cap on the state and local tax (SALT) deduction to pay for the inflation relief.

A summary of the legislation is available HERE. Full text of the bill is available HERE.

Recently, Grassley also introduced the Middle-Class Savings and Investment Act. This proposal seeks to provide targeted tax relief to lower and middle income Americans to help shore up savings accounts. Incentivizing savings could also help tame consumer demand – a driving factor of inflation. A summary of the Middle-Class Savings and Investment Act can be found HERE.

After the consumer-price index hit 9.1 percent last week, Grassley also spoke at a press conference to discuss how soaring prices are negatively impacting Iowans.